Crossing the student debt point of no return – for-profit colleges have default rates now rivaling subprime mortgage debt. $1 trillion in student loan debt on the horizon while college graduate wages fall for the decade.

The student loan market is back in the news as it makes its unrelenting march to the $1 trillion mark. This crippling figure comes in the face of a decade of lost wages for middle class Americans. Just like the housing bubble people were supplementing a disappearing middle class with more debt. The allure of housing was that never in our history have we seen national home prices fall, until they did in dramatic fashion. The same cultural nostalgia for education in every respect has created a zombie higher education system that is now expanding like the mortgage markets at the height of the housing bubble. Why? For-profit schools have largely lured in countless Americans into a system that has provided very little economic gains for students while enriching these Wall Street listed companies. It should come as no surprise that the highest default rates stem from the for-profit system and most of these loans are federal loans. In 2010 there were $100 billion in student loan originations, the highest ever in the midst of the deepest recession since the Great Depression.

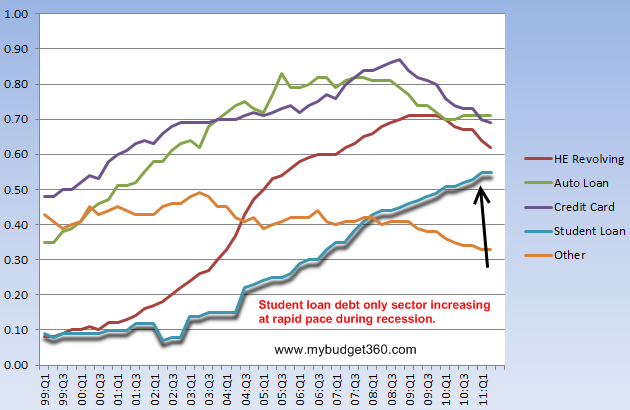

Student loan debt only segment of household debt expanding

The Federal Reserve tracks federally backed student loan debt and the figures are astounding. The only sector of household debt that has expanded in manic fashion during this recession is with student loans:

Every sector has taken a hit including:

-Home equity revolving debt

-Automobile loans

-Credit card debt

-Other debt

Yet there goes student loan debt saddling countless students with back breaking debt. Make no mistake, much of the for-profits are growing simply because of the government:

“(USA Today) For profit-schools. The highest default rates are at for-profit schools that tend to serve lower-income students and offer courses online. The University of Phoenix, the nation’s largest, got 88% of its revenue from federal programs last year, most of it from student loans.”

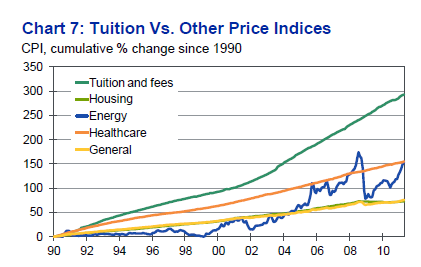

This is absolutely nonsense and shows how the coupling of Wall Street and the government have simply turned education into another commodity to water down and gamble on. Like the multiple card game tables in Las Vegas higher education is the hottest game in town. The increase in tuition has surpassed virtually every other category in our economy:

Source: Moody’s

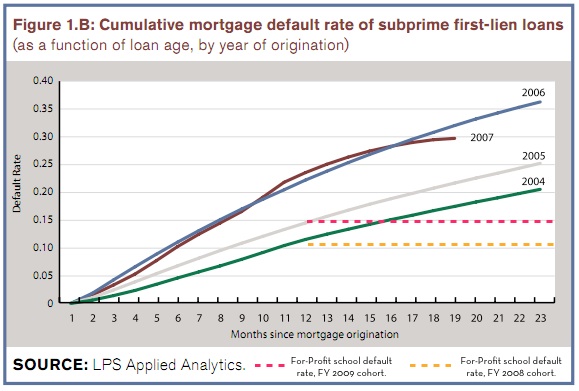

How is this even possible when incomes are falling? Similar to the housing market, people are going into debt. Of course education has value and is important. Yet there is a big difference graduating with $10,000 in student loan debt with an engineering degree from a state school versus coming out with $50,000 in debt from a for-profit studying some non-marketable skill. The for-profits lobby our government which is beholden to big money interest and this shell game continues. The default rates for these institutions now rival that of subprime debt:

Source: RortyBomb

“(Department of Education) The U.S. Department of Education today released the official FY 2009 national student loan cohort default rate, which has risen to 8.8 percent, up from 7.0 percent in FY 2008. The cohort default rates increased for all sectors: from 6.0 percent to 7.2 percent for public institutions, from 4.0 percent to 4.6 percent for private institutions, and from 11.6 percent to 15 percent at for-profit schools.”

While the stock market has gone absolutely nowhere spinning its wheels in the economic mud for over a decade these for-profit schools have done extremely well:

Yet it isn’t only the for-profits that are benefitting from this massive bubble. You have many private institutions saddling students with large amounts of debt and sending them off into a market with fewer job opportunities. Some argue and point to the lower unemployment of college graduates. Okay, but you need to remember we are looking at people that graduated before this entire bubble in higher education started (and also landed jobs in better times). The bubble really went nuts starting in 2000. Yet if we look at the earnings potential during the bubble years we see a very troubling picture:

Source: BusinessWeek

Since 2000, in real terms college costs are now up by 23%

Since 2000, in real terms real pay for college graduates is down by 11%

Does it make sense to pay more for something that isn’t seeing a growing rate of return? Part of this is the mixing of paper-mill graduates with students overall. We have heard countless stories of people going to for-profits only to land minimum wage jobs once they graduate. Just like the subprime debacle, many of these people will remain silent and the market will pretend nothing is wrong. That is until the default rates start soaring like they are today and then it is game over.

Some even question the $1 trillion figure that will be passed this year but this sounds about right given the Richmond Fed wrote about this last year:

Source: Richmond Fed

After you combine all the federal loans, private bank loans, and private institution loans you can see how this is getting out of hand. $100 billion in student loan debt was taken on in 2010. How much has been pumped out in 2011? Did we not learn anything from the housing bubble? Maybe we did but the banks and the government is more than happy to fleece the public until something is radically changed.

The Federal Reserve advance federally backed apprentice accommodation debt and the abstracts are astounding. The alone area of domiciliary debt that has broadcast in berserk appearance during this recession is with apprentice loans.

ReplyDeletePPI