The Federal Reserve is primarily concerned with one thing and that is to protect the interests of the banking industry. The Fed has no desire or need to protect the underlying economy. If they can get away with allowing banks to jump from one bubble to another they will do so. The success of the overall economy is only consequential if it aligns with the deeper interests of the banking cabal. This weekend former Fed Chair Alan Greenspan mentioned that simply bailing out Greece was a temporary measure. When pressed he went back into “Greenspeak” and rambled on in his typical obtuse language. The reason why global banks fear Greece is not because of the country itself, but because the country has billions of dollars in debt that global banks hold. These banks do not want to pay for their bad bets and would rather shift the cost to the overall population in general. The Fed balance sheet here in the U.S. is now up to $2.84 trillion, another record that gets no airtime in the press. The Federal Reserve continues with clandestine bailouts only to protect the interests of the banking elite.

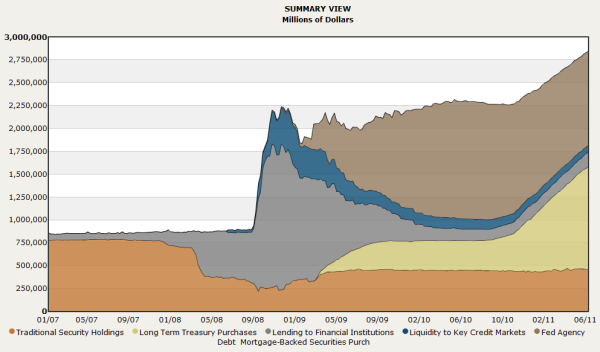

Fed balance sheet reaches $2.84 trillion

The Federal Reserve balance sheet is now up to $2.84 trillion. The Fed has become the silo for shadow bailouts including bailouts for the commercial real estate industry, toxic residential loans, mortgage backed securities, and even loans that have no business being on its books. Yet all this is seen as providing more liquidity for the banking system in the country. Since the crisis started four years ago little benefit has been seen in the underlying economy. Keep in mind the fiscal stimulus which is a fraction of what the Fed now holds on its balance sheet is what many Americans see on infrastructure projects. The total amount spent since August of 2008 approximates $550 billion (roughly 3 percent of GDP). On the other hand the Federal Reserve balance sheet specifically targeted to the banks now is up to 20 percent of GDP.

Of course little is discussed in the press about the Fed balance sheet. The Federal Reserve has specially focused on bailing out the banking sector and this has worked well. The too big to fail banks are now larger and profits are back to record levels. Their biggest success was ripping off the public and more specifically have kept most of their hidden secrets buried deep in the belly of the un-audited Federal Reserve balance sheet. We know that the Fed is holding $2.84 trillion in various “assets” but what exactly is being held? They would like the public to believe that only pristine assets are being held in exchange for U.S. Treasuries but in reality the Fed is purchasing every questionable asset under the sun. The Fed is ignoring the needs of the economy and simply focusing on protecting the interests of the banking elite.

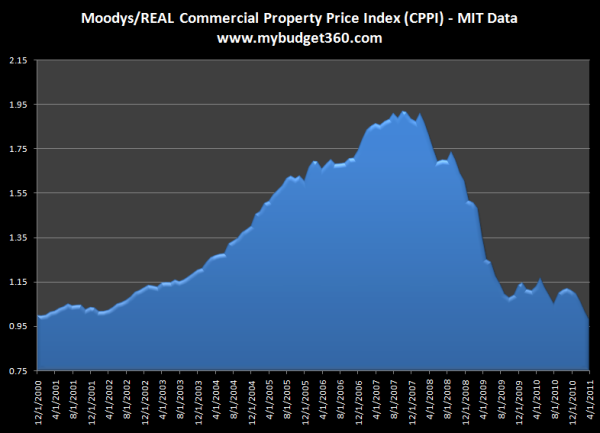

Case and point with commercial real estate

Source: MIT

Commercial real estate values have plummeted by 50 percent since their peak. The crash has been monumental and devastating for the industry. Yet banks have shifted many of these bad loans fixed to CRE and have “temporarily” placed them at the Federal Reserve. This isn’t a tiny industry. The CRE sector at its peak reached a nominal value of $6.5 trillion. Today the value has fallen closer to $3 trillion. Many of the CRE properties are solidly underwater yet the Fed has given the banks time to figure out ways to stuff their bad loans into the belly of the Fed balance sheet.

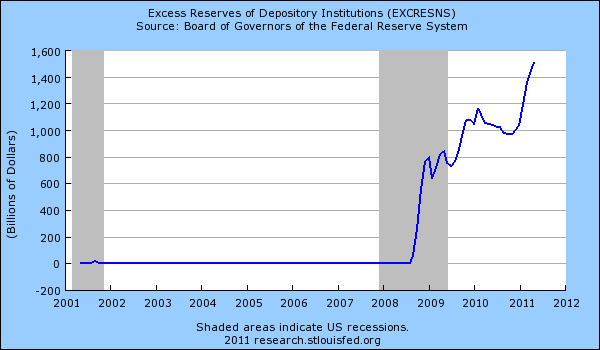

The banking system has plenty of money to lend out to the public:

The above chart shows how much money banks currently have that is readily available to lend to the public. Yet these too big to fail banks would rather keep the funds at the Fed and earn 0.25 percent on the money while they decide what other bubble they will jump into next. The too big to fail banks have nearly $1.6 trillion in excess money to lend to the American public! This is money that back in 2007 they claimed they needed to help small businesses and keep credit going. All of that was a lie and what really was the main purpose of the bailouts was to save the banking industry on the backs of taxpayers. As the chart clearly shows, the banking system is simply looking for their next big profit machine and all that excess reserves has come from the Fed being friendly with their banking cronies.

Squeezing the working and middle class

The line out of Wall Street banks has now shifted from:

-(2007) We need money from the Fed to keep money going to American families and small businesses.

And the new line now follows:

-(2011) We need to cut spending and wages to keep competitive in the global marketplace.

What happened to lending to American families and small businesses, the actual reason for the bailouts? These financial liars of course will say anything to steal more taxpayer money. Now it is a narrative of more stealing. These bankers of course don’t follow that line of cutting their own wages but then again, what do expect from the new oligarchy sponsored by the Fed?

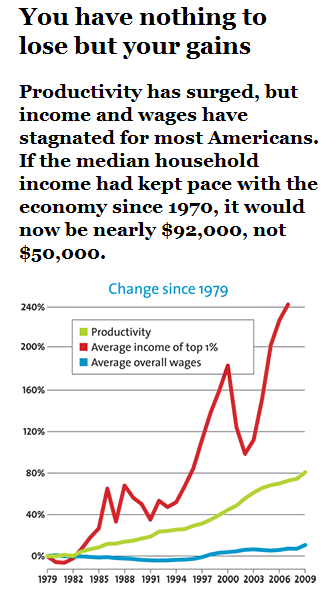

The stats show something very different:

Source: Mother Jones

I’m glad the middle class battle is now being picked up by more places. If median household incomes had kept pace with the productivity of the economy the median household should now be earning $92,000 a year instead of $50,000. As the chart above clearly shows, the vast majority of productivity gains have gone to the top 1 percent who have seen average income soar by over 240% since 1979 while average overall wages for working and middle class families have gone up roughly 10 percent in real terms.

The Fed and its banking cabal would like you to believe that now, everyone needs to live on wages slightly above minimum wage while the pinstriped suit bankers continually squeeze out more and more profits through bailouts, rip offs, financial alchemy, or simply by robbing taxpayers. This is the new business model. The Federal Reserve has failed its mission in many facets because when push comes to shove it is willing to sacrifice the economy for the sake of the elite banking sector. Banks should become like a utility and strictly regulated with force. Commercial and investment banking should be completely split. Hedge funds should receive no special privileges especially when many make money by creating investments that sink the economy and also receive bailouts thanks to political connections. You wonder why unemployment is still too high and wages continue to fall? Look no further than the beast that is the Federal Reserve.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

No comments:

Post a Comment